Lessons Learned about US Economy

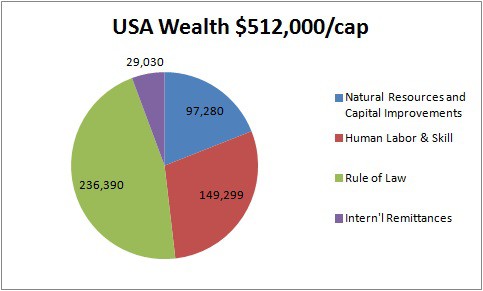

Economic Value of Civilization

- More than half of our wealth depends on the social fabric, trained workers, clear property rights, and stable government.

- Cheating the tax man only works if everyone doesn’t do it. Because a cheat only benefits if the society continues to provide the safeguards that allowed the cheat to make and keep wealth.

- Paying taxes are the price of success, not the onus of wealth.

Invisible Hand of the Marketplace

- Adam Smith named the unseen force that guides individuals to unwittingly benefit society through the pursuit of their private interests.

- But the Fallacy of Composition often short-circuits the Invisible Hand. If it’s good for one, it’s not always good for all.

Capitalism and the Free Market

- They work well together.

- They require unfettered access to information and ease of entry for competitors.

- Unfortunately, successful companies want to keep unfavorable information hidden and want regulations that inhibit competition.

Government Deficit Debate

- Make a mistake by not considering Net Worth.

- Fifty billion dollars on road building lower the cost of transportation for decades, not just the years the money is spent.

- Homeowners know that a mortgage will put them in a budget deficit but is a valuable tool to increase their net worth.

Corporations

- Should not have a separate political voice from their owners, as this doubles their leader’s voices.

- In addition, corporations have foreign interests that often do not align with US interests.

2017 Tax Cut Impact

- Used two primary avenues to boost the economy, reduce corporate taxes and reduce individual taxes.

- Of the $100 billion reduction to corporate tax bills (in the first of 10 years), less than 10% flowed out of the financial system and into the GDP. Ninety-one percent was spent of dividends and buybacks.

- Of the $200 billion reduction that taxpayers received in the first year (of a total $500 billion over 10 years), about two-thirds flowed directly into GDP.

- Conclusion: Bottom-Up tax cuts increase GDP more significantly than trickle-down tax cuts.

Pandemic Lessons

- Everyone needs to be healthy for the economy to flourish. National health insurance is wise.

- We underpay many workers who perform essential services.

- Businesses don’t like the immutable laws of the marketplace when they indicate many of them should go out of business.

Additional Information

Economic Value of Civilization Not just resources

Invisible Hand Operation, consequence, and requirements

The Invisible Hand’s Scar Abuses that can occur

Good For One Fallacy of composition in action

Missing Side of Budget Debates All businesses must file net worth statements. Why not government?

Corporations The Constitution doesn’t mention corporations.

Lane between Wall Street and Main Street Visual showing money flows between financial world and GDP.

2017 Tax Cut Impact Clear comparison of bottom-up and trickle-down effects on GDP.

Lockdown Economic Takeaway Let’s not forget who had to work to keep our society operating.

The point about spending on roads lowering the cost of transportation for decades: is that true? For highways the money may allow for greener construction materials and more lanes to reduce congestion but if induced demand traffic is a real phenomena, then the congestion reducing benefits will be short lived. Does the government claim this spending on roads is an investment that will pay for itself? From what I’ve read, the money will go towards repairing/upgrading existing road infrastructure. If all of the roads are really a worthwhile investment, then why have they fallen into such disrepair and now need emergency funds from the federal government? How will this situation not repeat itself again in another generation?

To me, it seems like the root problem is not a lack of money to support infrastructure, rather the way we’ve implemented infrastructure (e.g. public transit not existing or not being an acceptable option, low density sprawl that requires more infrastructure but does not pay sufficient taxes for services). What about rethinking infrastructure projects with a focus on being financially self-sustaining?

I have not looked up infrastructure payback time lately (also I meant it to include bridges, tunnels, airports, and the like in the term).

Your point about induced demand I recognize and would label it as an expansion of the net worth of the nation, although you may not.

The Eisenhower Infrastructure Bill of the mid-50s is a source for cost versus benefit, which continues to this day.

Your point about more sustainable infrastructure projects (based on better planning) I certainly agree with.

Road infrastructure being an asset and adding to net worth should be balanced with its role as a liability too. Do highways/roads currently get counted towards the net worth of the nation/state/city? Their construction certainly creates an asset, but do governments attempt to evaluate their value? I’m not yet sure which methods state and federal gov use, but I found this paper to be similar to what I’m interested in: https://mdpi-res.com/d_attachment/sustainability/sustainability-14-04375/article_deploy/sustainability-14-04375-v2.pdf?version=1649324116

I’m glad you mentioned the Eisenhower Infrastructure Bill as I hadn’t looked into that much. It looks like reliance on a gas tax was a major contributor to funding maintenance, but the federal tax rate is fixed and has not stayed current with inflation. The new infrastructure bill did not adjust this tax, and suspension of the tax has been proposed to control the rising cost of gas. Additionally, EVs and hybrids are demonstrating that relying on a gas tax is not keeping up with the evolution of vehicles ( https://www.consumerreports.org/cars/hybrids-evs/without-a-gas-tax-how-will-evs-be-charged-for-road-use-a1206432507/ )

One worry, it seems, to raising the cost of driving (taxes, tolls, gas, electric charges) is that people and companies would drive less with the increased costs so there still wouldn’t be enough money to support all of the roads. To me, that speaks to the real possibility that we simply have too many roads, bridges, etc to support.

Roads, bridges, etc are essential and should exist, but not at their current scale. I often hear of lifestyle, environmental and safety reasons to favor fewer roads/cars and I’m starting to believe that there are obvious financial motivations as well. Would it not make sense to have less but more effective infrastructure? E.g. public transit that lots of people want to use, a return of mixed use commercial/residential areas to reduce distances of day-to-day tasks from homes, biking/walking as a useful means to go somewhere rather than pure recreation.

Governments in the United States do not tract net worth, whether it’s increasing or decreasing. That is a severe shortcoming in evaluating the country’s fiscal condition.

Community planning and zoning boards have not done a solid job on adjusting to lifestyles and environmental changes. Commercial interests have done no better with their planned obsolescence to ensure their future sales.