Tax Cut 2017 GDP Impact

Update: 2024.07.10 The US government debt, ballooned by corporate tax giveaways and pandemic spending is coming back into attention. The differences between the 2017 Tax Cut claims and the actual results should not be forgotten.

Only a part of the recent tax cut will add to GDP growth. There are two main components to the tax cut—decrease the tax paid by households and decrease the tax paid by businesses.

Purpose of Republican Tax Cut Bill

The justification for a tax bill should be—will it help or hurt the economy and the population?

The present tax bill plans to reduce business taxes by $1000B, while individuals will see a reduction of $500B in the next ten years.

- There is the trickle-down idea. In this case allowing business twice as much. Economists have thoroughly debunked that idea.

- I will deal with from a different angle. What will be the GDP impact and its cost in the first year (2019) of the proposed tax reduction?

- A final point, though I also don’t address further in this post, is that the tax bill will grow the government debt. As Republicans long preached before their apostasy, annual deficits that grow government debt have the danger of overwhelming the economy with debt which can’t be carried. It is a folly that net worth is not considered alongside the yearly budget, because some debt can be carried when net worth is growing.

GDP Impacts

I focus on GDP change because economic activity is the means that most people gain benefit from the economy. What else is there you might wonder? The stock and bond markets draws funds. Rising stock prices—inflation that is not measured in CPI—are financial windfalls which occur on Wall Street are not tallied in GDP.

A practical consideration. The rich have become rich in the system already—through hard work, planning, system support, and even luck. Since they are already prospering, why should they be the prime beneficiaries of changes to tax codes.

If the markets rise, they does not help wage earners in daily life. For that we must consider, salary growth and consumer inflation.

Households

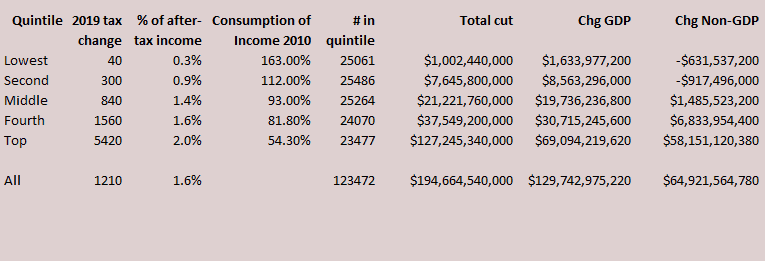

The table (Figure 1) is based on the historical spending patterns of households according to income. The richest people consume about half of their income, contributing to GDP. The other half goes to investments, which does not add to GDP activity.

The consumption by household income level is a dense chart. A brief discussion of the columns supports the summary as people’s wealth increases, their gain in disposable income contributes less and less to GDP growth.

- The first column divides household incomes into named fifths (quintiles)

- The second shows the actual increased income per household due to the new tax law

- The third column calculates the fraction amount of income that the tax law reduction provides. It goes up as people becomes wealthier.

- The fourth tells the percentage of their income that the households consume. For example,

- The poorest consume more than their income—163%. Although their income averages $13,000, they consume $20,000. This is accomplished by government welfare, charities, family gifts, and underground economy.

- The richest consumes 54.3% of their income.

- The fifth column displays the number of households (thousands) in the section. The poorest has 25,061,000 households. The richest fifth has 23,477,000.

- Next, in the sixth column is the aggregate amount of tax reduction for the group. From $1 billion for the poorest to $127 billion in the richest.

- The seven column estimates the immediate impact on GDP assuming each household consumes the same fraction of their tax reduction as they currently do.

- The final column shows the amount of excess income due to tax reduction that the household will be saving and investing. The top two household groups spend more than they make, thus their contribution to investment is negative.

Bottom Line on Household Reductions

The bottom line is that $129B will be added to GDP from the $194B in increased take-home pay for all householders. Not bad, about 0.7% of our $18.6T GDP. Two-thirds of the individual tax reduction grows GDP and overall health of the economy. The non-consumption income feed into financial institutions will result mainly in inflation of asset values.

I’d be remiss if I didn’t mention that nearly $200B of the total $500B individual tax reduction occurs in the first year. The tax savings for household go down dramatically as the years go on.

Businesses

A big part of the hype about the tax plan is that businesses will use their tax reductions to invest in their businesses and new ventures. I don’t know of anyone who wishes that to be false, but is that wish reasonable?

Business investment contributes about 16% of GDP. Most of that is in support of ongoing business activities. Research and Development (R&D), the manner in which next business opportunities arrive, is estimated to be 2.79% of US GDP (by Visual Capitalist).

Before discussing corporations, let’s discuss small businesses and pass-through entities.

Small Businesses

- 90% of small businesses pay less than 25% tax rate. They will see no benefit from the business tax rate being cut to 25%.

- 10% of small businesses which pay above 25% tax rate will be the only small businesses that benefit from the tax cut. They already earn 50% of all small business profits.

- The tax rate change will benefit the small businesses that already are flourishing. They will be given an addition financial benefit to beat their small business rivals with. That’s anti-Free Market.

Corporations

When they see larger numbers on their after-tax profit, corporations have shown the actions they take with their tax cut money. Only a very small fraction of their gain goes to business activity which increases GDP.

- Stock buybacks. Inflating the share price and increasing the earning per share, so company executives get bonuses and large shareholders hold stock of increased value.

- Dividends.Paying money to stockholders. In 2016, 40.2% of all S&P 500 corporate income was paid out as dividends.

- Yardeni, Research, Inc. calculate that S&P 500 companies paid out 91% of their operating income as buyback and dividends in the 2nd quarter 2017.

- Perhaps there will be a tiny increase in Research & Development out of the remaining 9% of their tax reduction.

Summary

The new tax law will increase household spendable income enough to increase the GDP, a small 0.7%. The corporate tax change will put upward pressure on stock and asset prices. It will also increase financial maneuvers, which are not new business investment.

The upshot of the Republican Tax Cut bill will be a minor increase to GDP due to increased consumer consumption yet a major increase to stock prices due to reduced corporate tax liability and increased funds looking for investment homes.

Additional Information

The Narrow Lane Between Wall Street and Main Street explains why only a small fraction of government largesse flows from the financial markets to everybody’s pockets.

Federal Economic Policy presents the argument that corporations should be taxed at same rate as individuals.

1 thought on “Tax Cut 2017 GDP Impact”