Pandemic Economic Valuations

Looking out at trees and few cars and walkers, taking a break from the sour TV news, the pandemic precautions have exposed a fault-line in economic valuations that is striking.

Economic Markets Today

The stock market has dropped 30%. It might pick up 5 or 10% today. It’s a sign that financial traders don’t know how significantly the economy is being hurt by the wide spread lockdown of people into their homes and not at their jobs.

Fortunately, our necessities (food, shelter, medical care, remote schooling, and safety) are hobbling along. Grocery stories and delivery services are doing a booming business. Local medical services may or may not.

Everything beyond the necessary (and their supporting) sectors, we now see are discretionary. That includes vacations, entertainment, restaurants, etc. Many of the things we like most about living. They have declined the most in the stock market.

Return to New Normal

Social distancing will continue. That will affect workplaces as well as leisure activities. Both will be affected negatively. Productivity will suffer as will spending on non-necessary goods and services.

Goldman Sacks forecasts a 24% fall in GDP this quarter and a rapid recovery netting to -4% for the year. I fear they are too optimistic. Unemployment and layouts are already rising.

Government Actions

The federal government should guarantee long unemployment benefits for the millions dislocated by the economic fallout of the pandemic.

Congress should not bailout companies except those associated with satisfying primary needs of people. Airlines, for example, should not be bailed out. Fed Ex and the other companies delivering essential supplies will be guided by usage. Optional air travel and cruise lines should also be guided by usage, not government bailouts.

Bailouts should be restricted to individuals, to support them during the crisis, and to support the services and goods they need. The essential businesses.

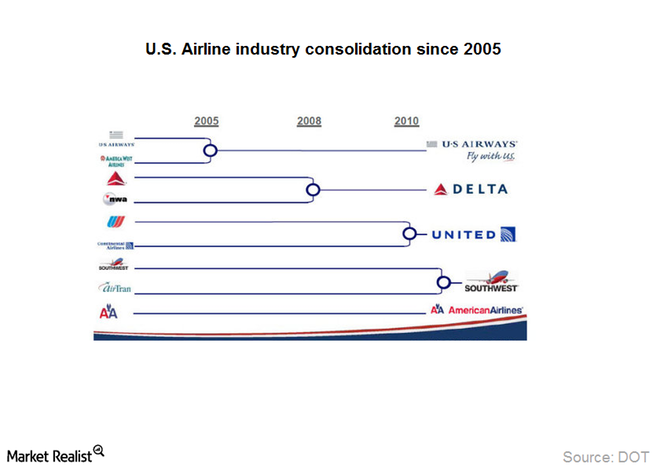

Airlines have shown the capacity to consolidate. More consolidation, as well as overall shrinkage, will be the likely result of travel changes.

Let the free market do its creative destruction. Let them merge, combine, and adjust to the amount of leisure and non-essential activity that follows the current chaos.

The immediate bailouts and Fed liquidity measures will mask only temporarily the changes in consumer patterns that are coming and the structural shifts they will demand.