News with a Twist

Items in news can lead to insights beyond their apparent straight-forward content.

Here are four recent stories that imply something else about the United States’ economic situation.

Making Money in the Stock Market

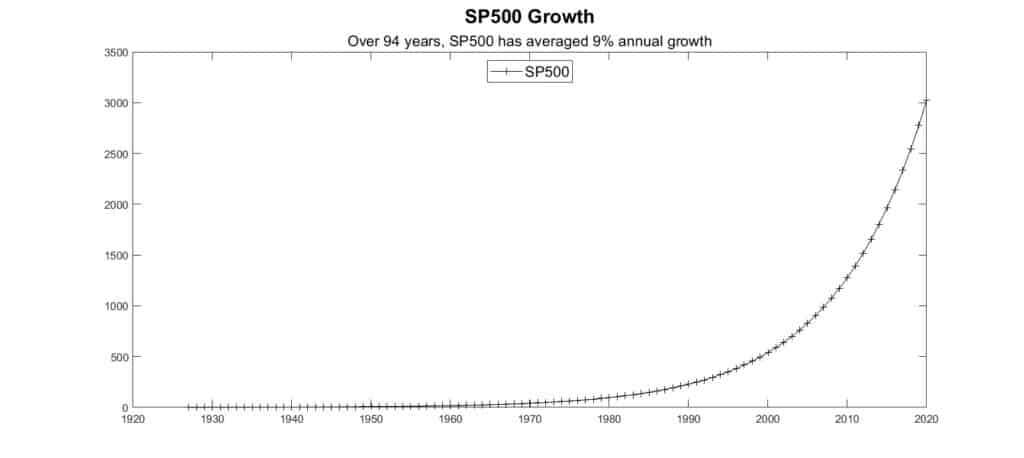

The financial press cites the SP500 average growth rate as an inducement to invest in the stock market. I have relied on that analysis in my own investing. The S&P 500 stock gauge has averaged rising 9% annually from 1927 through 2020. The chart below shows that one dollar invested in 1927 would be worth slightly over three thousand dollars in 2020.

Twist

How is this amazing SP500 growth rate achieved?

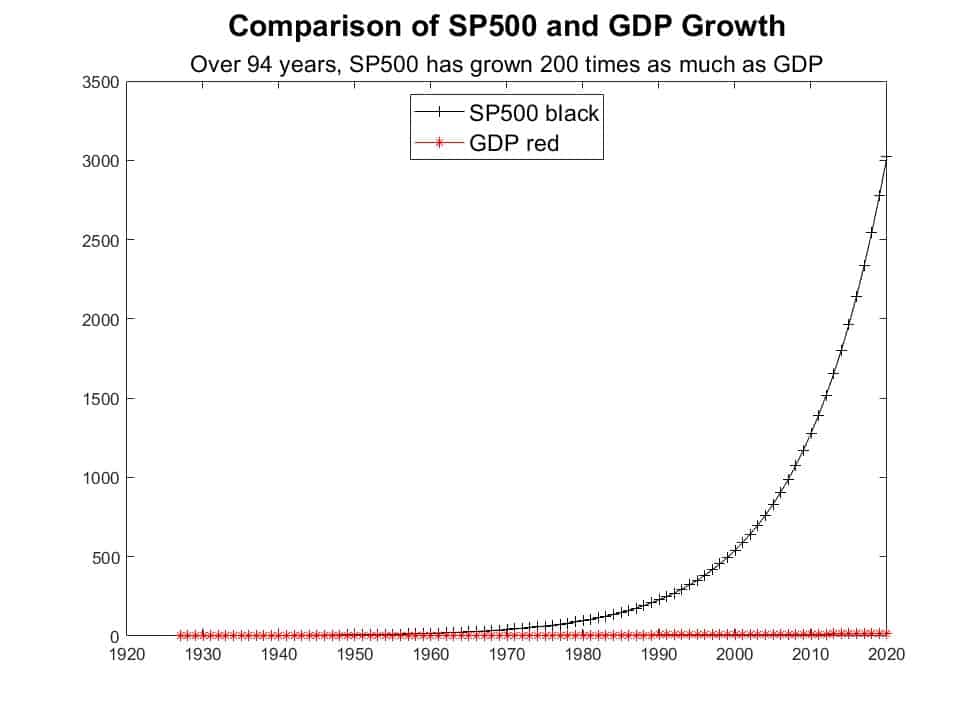

The stock market is supposed to reward the growth in economic activity. A little research reveals that over the same period (1927-2020) the United States GDP has an average growth rate of 3%.

That’s the red line at the bottom of the graph above, barely separated from the bottom axis. The GDP growth of 15 times is swamped by SP500 growth of 3000 times.

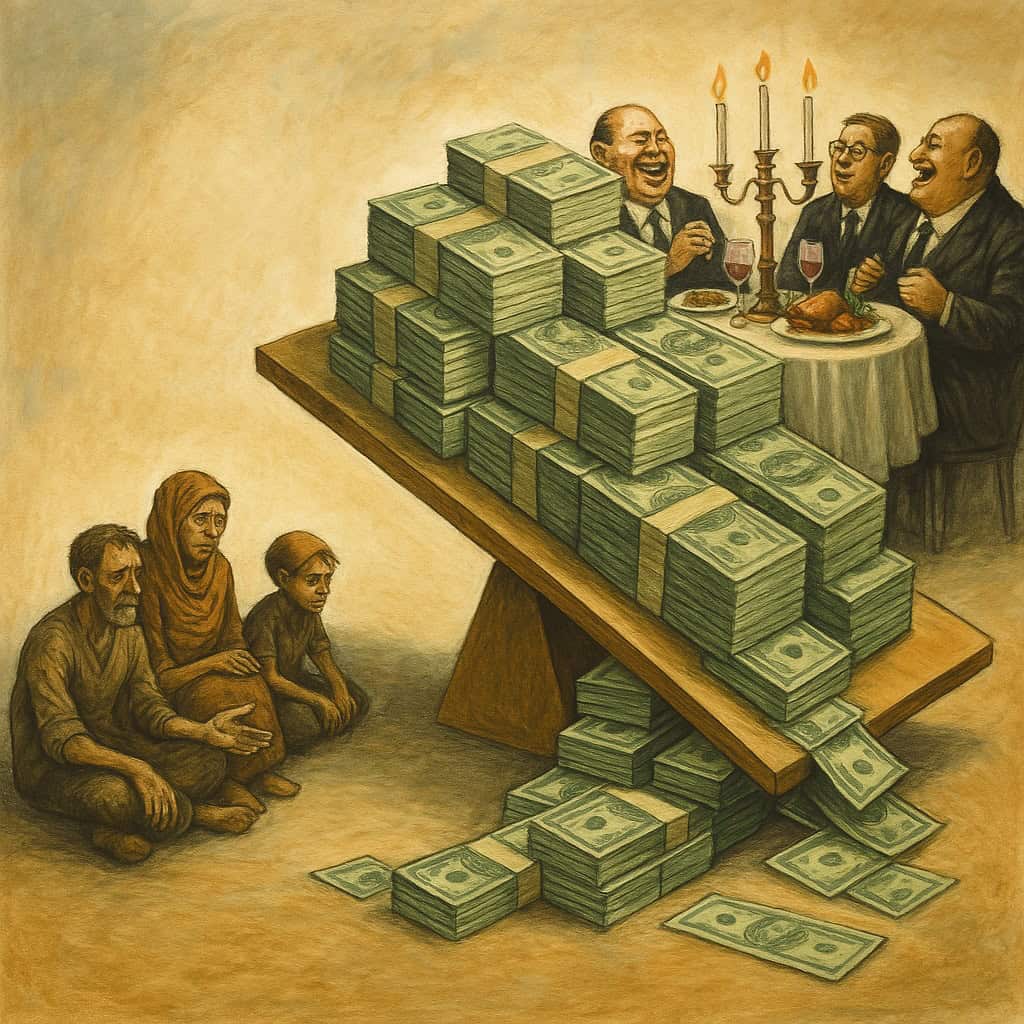

That the ordinary worker has been systematically underpaid in relation to their contribution to the growth in corporate profits. Workers are always being told, “Don’t ask for a wage increase greater than the growth in employee productivity,” which is currently estimated as 1%.

However, according to the Economic Policy Institute, the growth in productivity has more than doubled that of growth in hourly compensation for US workers since 1948. With net productivity in the country growing by roughly 253 percent in the last seven decades, hourly compensation has increased by just 116 percent.

One way that the SP500 growth has exceeded GDP growth is by withholding wage increases from workers.

Another contributor is because of the narrow lane between Wall Street and Main Street. More profits are kept in the financial world than delivered to the real world economy.

Free Market Proponent

Merck is suing the United States government to stop drug price competition in Medicare.

Twist

One of the largest pharmaceutical firms admits it doesn’t support free markets, when such competition cuts into its profits!

Stock Buybacks

Nvidia recently halted an authorized $10B stock buyback after only $3B were spent. It was authorized because they had excess retained earnings they could not apply to operations or find other investments for. With the tripling of their stock price yield-to-date—AI fever for their chips—the stock buyback was no longer cost effective.

Twist

What about the work force that generated the products that powered those excess earnings? Shouldn’t workers participate when the execute board can’t find a more productive use of excess earning than stock buybacks? Yes, they should participate.

The rules of incorporation should, as the price of limiting the liability of officers and stockholders, require that stock buybacks, retained earnings beyond the needs of operation, dividends, and future investments, must be matched by an equal amount as worker paybacks.

Inverted Yield Curve

When shorter-term interest rates are greater than those for longer-terms, the financial media commentators claim that the inverted yield curve often predicts a coming recession.

The general economic theory is that the longer term you borrow money for, the higher the interest rate should be. That compensates for the additional risks more time allows one to be exposed to.

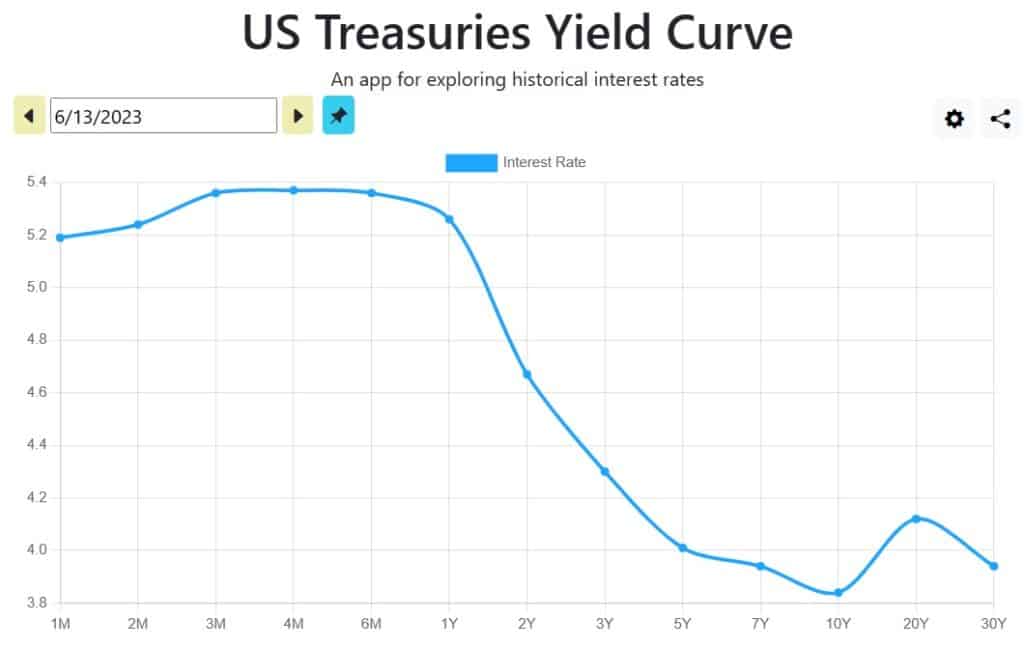

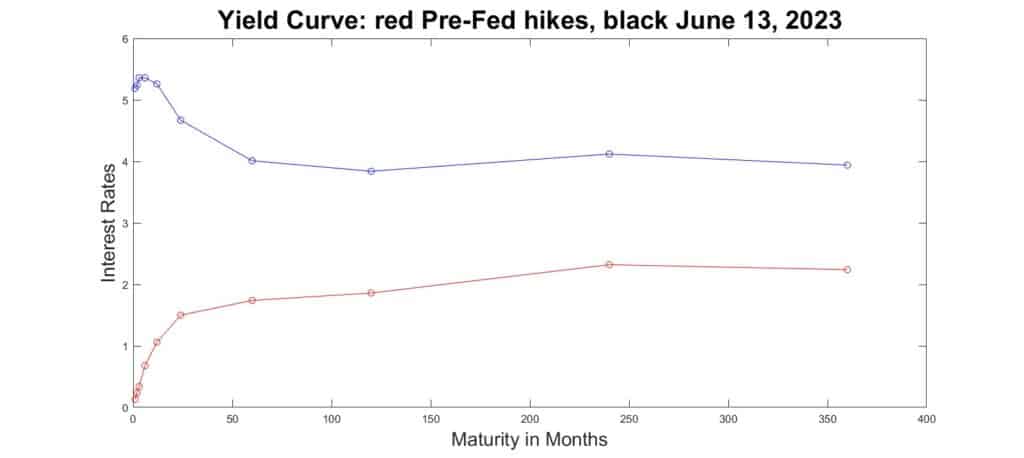

Below is the standard presentation of the yield curve for a recent date.

You can’t miss the mountain ski drop in the mid-term (after the high rates on the chart left). It’s a useful chart for discussing the yield profile, but I am dissatisfied with it on two points. By truncating the vertical axis of Treasury yields at their low point rather than at zero, the change is magnified. Also, the maturities on the bottom axis are not measured equally. The length between one month and two-month treasuries is the same as the length between 20 year and 30 year treasuries. That exaggerates the appearance of yield bump at the bottom right.

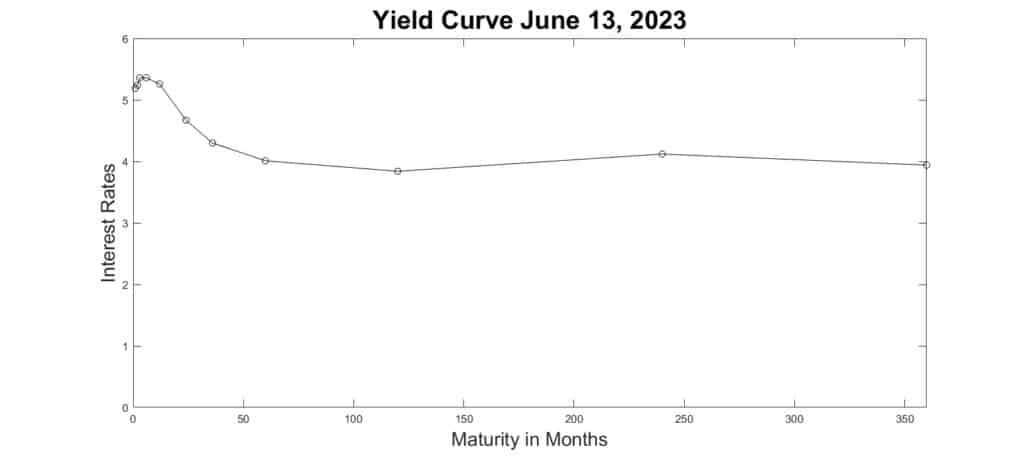

Below is the same yield curve by on a scale to remove the exaggerations. You can see the definite rate inversion is prominent in the earliest months of loan maturity. Also, the interest rate bump in later maturities is much less noticeable.

But does the inverted yield curve imply a recession is coming?

While I was at it, I added the yield curve (in red) from before the Fed started rate increases to the current state of the yield curve. This allows a view of the impact of the Fed’s actions of recent hikes.

The front end of the yield curve has been jacked up by the Fed’s increases to 5%. Loans of maturity greater than 5 years have increased about 2%, resulting in the ski slope inversion of short-rates being higher than long-term rates.

Twist

The yield curve inversion is caused by the Fed raising short-term rates to stifle inflation. Their efforts often results in a recession, but the rate inversion is not an independent sign of looming recession. It’s a result of the Fed action.

Global Currency

After with the US Congressional stalemate debt crisis (thankfully resolved) raising worries about the US paying its debts, articles in Reuters and elsewhere worry about the decline of the dollar as an international currency, because of US sanctions. There are claims that Russian-Chinese trade denominated in renminbi has exploded.

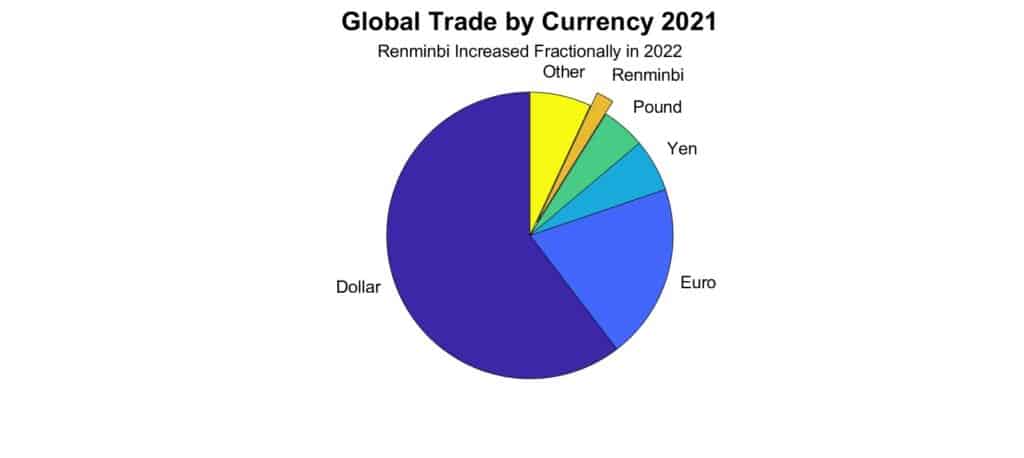

Will the US dollar be dethroned by another currency? Below is a breakdown of the currencies used in world trade in 2021. Russian-Chinese renminbi-denominated trade increased only one half of one percent in 2022.

Twist

The same financial opinion-makers who worry that the US is losing its world economic dominance to China ignore the significantly greater debt load that Asian country carries.

In the US, much is made of the enormous US debt, but did you know that on May 9, China’s Debt to GDP ratio was 2.8, while the US ratio is 1.2. Yet the commentators want us to worry about the rise of the renminbi.

Nonetheless, the United States must be careful of using economic sanctions, as they inevitably induce the sanctioned country and its trading partners to find a new currency to facilitate business. As Brian Eichengreen wrote in Extraordinary Privilege, the United States gains a tremendous surplus by its ability to issue US Treasuries, at virtually zero cost, and receives face value from foreign countries that use US dollars for global trade and reserves.

Additional Information

Productivity is Soaring, But Wages Aren’t Keeping Up World Economic Forum

Lane Between Wall Street and Main Street

Exorbitant Privilege. Barry Eichengreen. ISBN 978-0-19-975378-9

This is a great issue of Burning Thoughts. The articles on Implicit Learning and News With a Twist were very enjoyable. I also liked the article on the Stock Market. I see some other interesting titles to catch up on. It’s great getting this in my In Box every month. Thank you.

I’m glad you like it, Nancy.

News can get to me, especially when the consequences are significant and unremarked upon.