Jungle Rope Solution

How do you solve tricky computer problems? I faced such a difficult problem recently.

Using a software tool for portfolio analysis, I plot individual funds. Recently, I added a second fund to understand how the Fed’s rate hikes had affected the TIPS portfolio versus the effect on the US Total Bond Market.

However, when I added the second fund, I ran into problems. The software tool had changed the way it represented and handled dates for new code.

I spent many hours, too many hours tweaking the dates to make them acceptable to the new requirement, while trying not to disturb the code that worked for the first fund. I had forgotten the Jungle Rope Theory.

Definition

When using a new feature, create a test case which depends only the new feature and involves as little as possible of other tool features.

The Jungle Rope Theory states that it is best to solve the essential problem in the simplest way and, only when that is done, add the features to make the solution more practical and usable to the goal.

Why?

It rests on the observation that once Tarzan swings across a jungle chasm, he and others can use the jungle rope to transport other ropes and materials, so they can build a swinging bridge to span the gorge. Who knows, in due time, engineers may cart material across to construct a solid bridge.

The basic improvement to solution time is the simpler the test case, the easier to detect the problem’s root cause.

My excessive hours testing shows a pitfall of not having a simplest base case. I grafted the new feature onto an existing program. Secondary errors occurred, not caused directly by the date conversion. For instance, the fund plot failed with a date error. I thought the date technique I used was flawed, but it was not. I discovered later, with jungle rope testing, that my date conversion was good, but the plot parameters changed to accommodate the new date structure. Could I have discovered this in the complex case? Possibly, but I didn’t because I was unsure of the date conversion.

In Practice

I created a new program with the new fund and plot.

In fairly short order, I discovered the trick of changed date handling, which also affected the display, sorting, and filtering of fund data. Then, I created a plot, with another change because of the new date. Lastly, I aligned the date logic for both funds.

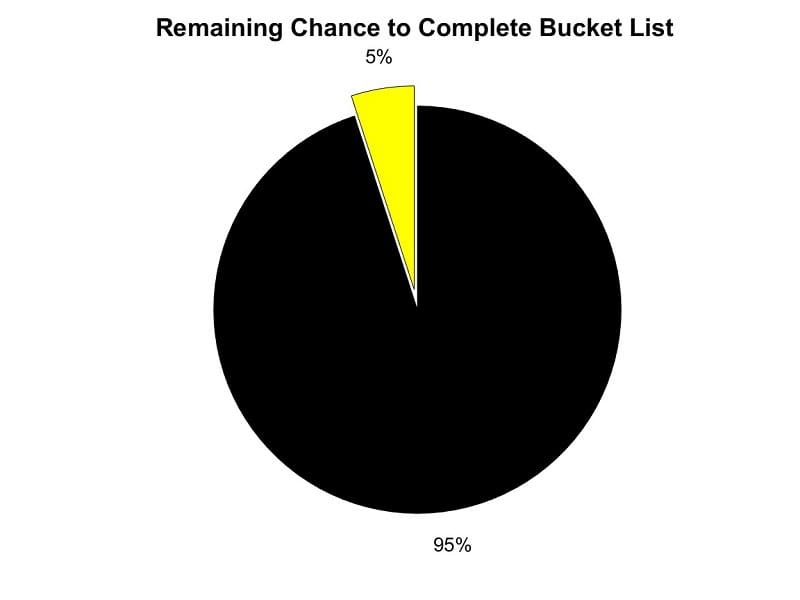

That accomplished, I see that the short-term TIPS fund fell about 1%, while the Total US Bond Market fell about 13% in the last 18 months.

Very useful information. Even a passive investor may adjust allocations when secular changes occur.

Image of Maze created by DALL-E at a prompt of logical pathways.

Additional Information

Limits of Perfection Overarching rule.

Treasury Interest Rates In 2019, the 10 Year Treasury rate dropped.