Exorbitant Privilege

Reading Barry Eichengreen’s latest book, Exorbitant Privilege. He is excellent on explaining econ history, but not so much on future projection. Exorbitant Privilege is about the benefit to the US from the dollar position as a reserve currency as well as to current problems to that status.

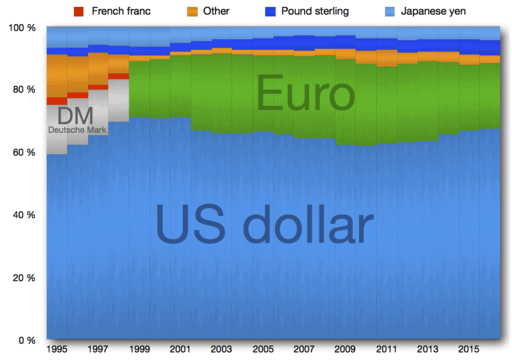

A reserve currency can be used in international transactions, international investments and all aspects of the global economy. It is often considered a hard currency or safe-haven currency. Currently the dollar and the euro are the primary reserve currencies.

Here are two nice facts he provides.

- Insofar as foreign banks and firms value the convenience of dollar securities, they are willing to pay more to obtain them. Equivalently, the interest rate they require to hold them is less. The effect is substantial: the interest rate that the United States must pay on its foreign liabilities is two or three percentage points less than the rate of return on its foreign investments.

- It costs only a few cents for the Bureau of Engraving and Printing to produce a $100 bill, but other countries have to pony up $100 of actual goods and services in order to obtain one.

Other Currencies

Since the advantages are significant for the relative success of US companies in the financial markets, any change to the dollar’s status as a reverse currency could affect portfolio plans, including asset allocation.

The euro is used for trade within the European Union. That is a significant economic bloc. Will their trading partners transition from the dollar to the euro to price their trade? Not so far. In particular, OPEC continues to price oil in dollars.

The Chinese renminbi is another currency to watch. The Chinese economy is growing faster than the US. Also they are determined (and patient) to make their economy a focal point of economic operations.

A very significant drawback to the renminbi is that its value is managed by the Chinese government. It is not allowed to float against other currencies. The danger for other countries is that tying to the renminbi would bring their nations under the sway of Chinese decisions and their local currency could not adjust to unfavorable policies by floating against the Chinese currency.

Graphic of global reserve currency holdings by Spitzl / CC BY-SA (https://creativecommons.org/licenses/by-sa/3.0)