Inflation, Fed Funds, and Economic Lags

The inflation that started in mid-2021 continued for numerous months before the Fed used their prime weapon, increasing the Funds Rate. Now, in November 2022, many economists and market watchers wonder: did the Fed waited too long to respond? Almost immediately following comes the question: will the Fed reaction tip the US economy into recession?

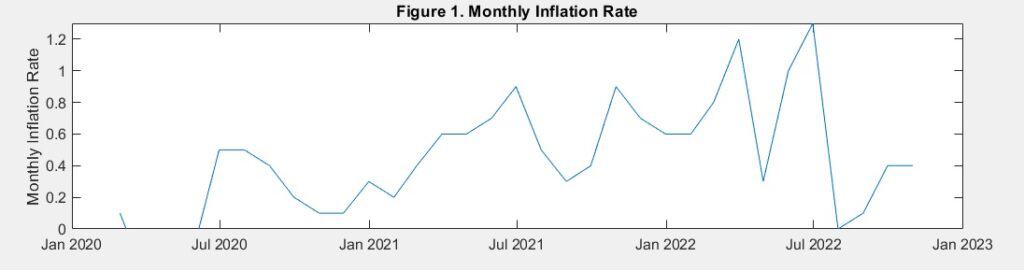

Figure 1 shows the monthly inflation rate, CPI-U (Consumer Price Index for urban areas). The jump in July 2020 was noticeable, then inflation tailed off until March 2021 for several months. A summer 2021 downturn was welcome, but even then, monthly inflation increased to 0.4% or more. Why didn’t the Fed act in July 2021?

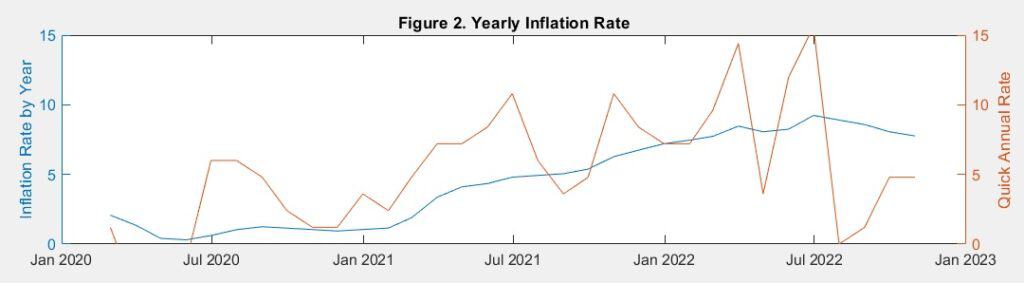

A look at Figure 2 the annual rate may help explain. The jagged orange line is a quick inflation estimate, calculated as twelve times the monthly rate. It is a forward-looking estimate of inflation. In July 2022, the quick inflation estimate is shocking, over 15%. The smoother blue line is the inflation experienced over each prior 12 months period. The trailing annual inflation rate has exceeded 5% since Aug 2021. Why didn’t the Fed act in September 2021?

Fed Decision

I am not trying to second-guess the Fed, but I need a handle on their approach to inflation. Understanding the inflation path is important to my spending and portfolio decisions.

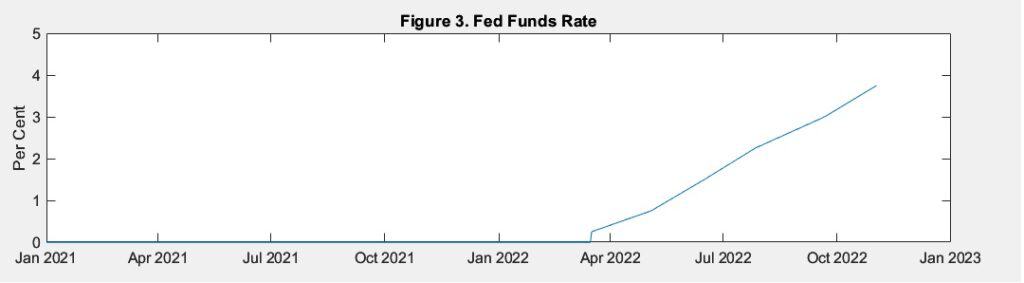

In Figure 3, we see the Fed left the funds rate at near zero until mid-March 2022, when they raised a quarter of a point. Once started, the lower bound of the Fede funds rate increased to 3.75% on November 2.

Comparing the monthly changes in inflation and Fed funds rate in the latter half of 2022 does not present a clear picture of a relationship between the two rates. A rapid decline in August 2022 of energy prices resulted in a 0% CPI increase. That change occurred to macro-economic forces, not the 0.75% Fed Funds increase on July 27. Two additional 0.75% increases have since occurred.

Has the Fed overshot the magnitude of funds increases necessary to quell inflation?

Lagging Effects of Fed Funds Rise

A difficult factor to consider is how long after the Fed’s increases do effects continue to suppress economic activity? The lag has two components.

- Financial impact lag, 1-3 months. Private residential fixed investment—mostly home buying—fell more than 25 percent in the third quarter at an annual rate. Commercial real estate and banking may soon start reacting by contracting.

- Economic activity lag. 12-16 months (Milton Friedman estimate). Rising interest cost reigns in new economic activity.

As of November, the financial impact lag incorporates funds rises through July. The economic activity lag implies that we have not seen their impacts yet.

Path of Inflation, GDP, and Unemployment

Using a boxing metaphor, inflation has won the opening rounds with the economy and the Fed. The Fed has split the middle rounds. GDP has watched from a neutral corner, dodging major damage.

Entering the final rounds, one has to wonder if the Fed is so focused on pounding inflation into submission that it overlooks the following (lagging) damage to overall economic activity and consequently higher unemployment.

Economic forecasts are often prefaced with ceteris paribus—all other things remaining the same, which is rarely the case. If the Fed raises its funds rate to 5% or more, which media reports consider likely, lagging economic forces will trail the fall in inflation and continue past usefullness.

My 2023 forecast, ceteris paribus, inflation will continue to fall towards 3-4%. That’s a victory; however, the Fed will overshoot the fund raises required, resulting in a downward turn of the business cycle with unemployment rising through the end of 2023.