Bottom-Up Tax Cut

Tax cuts should go to the lowest income earners. While they will pay less to the tax man— they will still be paying FICA, property, and sales taxes. They already spend all their extra cash. More money will be consumed and will flow through to all levels of the economy. This will grow GDP, as consumer expenditures comprise 75% of all GDP activity.

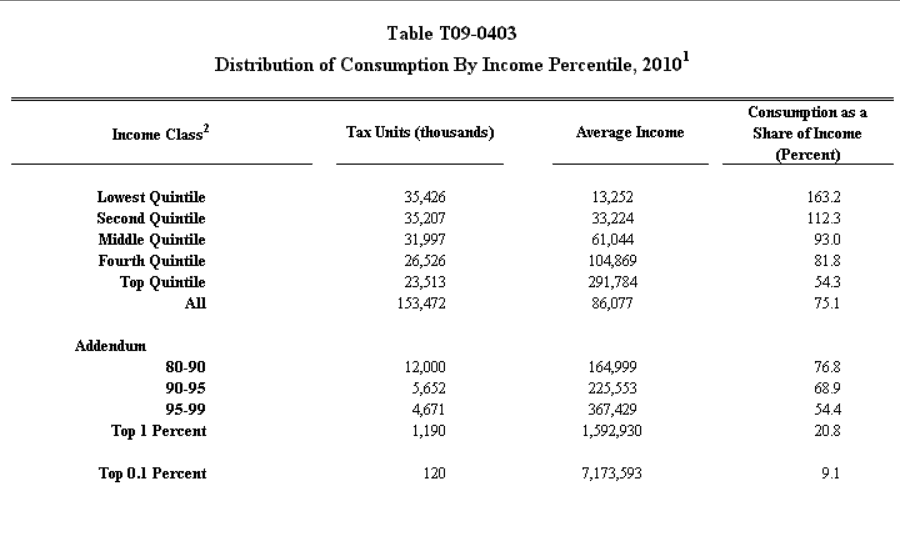

In Figure 1, the rightmost column shows that as income increases (going down the column) the percent of income spent on consumption declines. In fact, the top 0.1 earners consume only 9.1% of their income, while the middle group of earners spends 93% of their income.

This observation relates to tax cuts intended to boost the economy. Tax cuts delivered to the middle class and those with lower incomes will lead to nearly all of the tax cut contributing to GDP growth.

As we have seen over prior tax cuts that favored the rich, their new cash ends up in the financial markets, inflating stock prices and their wealth rather than accelerating GDP.

Top-Down Failure

Growth in the wealth of the wealthiest has not jump started the economy. Since the Great Recession, 93% of the income growth went to the top 1% of earners. Their deployment of additional money has been anemic for the overall GDP, for the entire nation. They consume only 20.8% of their income on consumption, which flows directly into GDP.

Figure 2. More money that you can spend

The Top-Down Problem

Their extra income goes into the financial sector, not directly to new plants or productive sectors that contribute to GDP. The money stays in the financial markets, contributing significantly to highs despite anemic GDP and corporate profit rather than to growth in GDP.

Current Tax Proposal

The current tax cut bill is estimated to increase the federal debt by $1.5 trillion over 10 years. Let’s consider the magnitude of that number. Each of the bottom 75 million earners, employees and small business owners could get a tax break of $2,000 per year for 10 years for that amount!

Bottom-Up Result

As of September 2017, there are 127 million people working full time. The 75 million, getting the proposed tax cut, would be the bottom 3 earning quintiles, the 60% of the labor force with the lowest wages. That reaches into the middle class.

As figure 1 shows, those 75 million beneficiaries spend over 95% of the money. The tax cut would be immediately consumed, growing GDP and increasing profits.

The real economy would prosper. Everyone would prosper.

Tax Cuts

Bottom Up, not Top Down.