Aggregate Effects of the Top 1% Earners

Let’s speak about the 2013 economy at a macro level. Consumers drive 70% of GDP. Earners in the top 1% of income have received 93% of the income growth since the depths of the Great Recession (Bloomberg). A perhaps surprising fact about those high earners—they will only spend on GDP goods 21% of their income (Tax Policy Center).

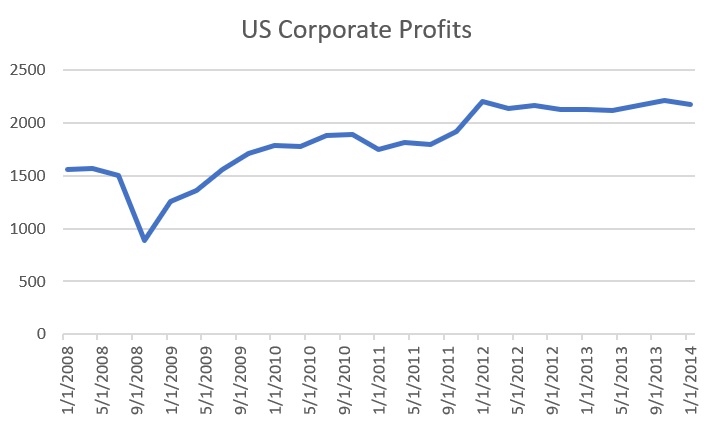

By the end of 2013, corporate profits had increased 39% beyond pre-2008 levels and more than doubled over Great Recession profit lows.

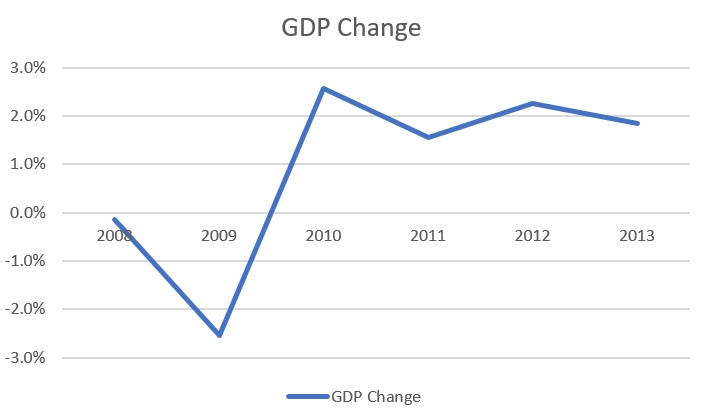

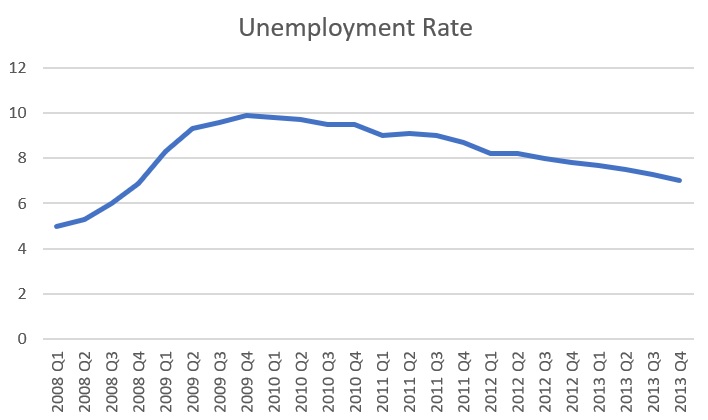

How have GDP and unemployment fared?

There has been slow growth in GDP, yet of the profits generated, 93% has been gone to the highest income earners. Since they spend but 21% of their income on consumption, most of the profit growth has been removed from the real economy and placed in the financial markets. That is a big reason that GDP hasn’t grown faster.

Some people argue that paying CEOs and others large salaries for their significant contributions to corporate wealth is just supply and demand. I won’t argue here about the lack of competition and the cozy relationships on compensation boards which undercut the requirement for free market supply and demand, let me just highlight the impact.

The people who spend most of their income—workers—are not getting wage growth sufficient to support a more consumption, which would lead to more acceptable unemployment levels.

Now some will argue that the Top 1% are funding business investment which will lead to future GDP growth—there is some truth to that, but more of the invested profits bid up existing companies (stock prices) rather than fund new ventures. Regardless of those details, consumption is not growing faster because wages are not being raised commensurate with profit increases.

With 93% of income growth being taken by the Top 1%, the salaries of workers and lower level managers are barely growing, therefore the nation’s GDP barely grows.

Growth for the American economy requires salary growth for American workers.

2 thoughts on “Aggregate Effects of the Top 1% Earners”