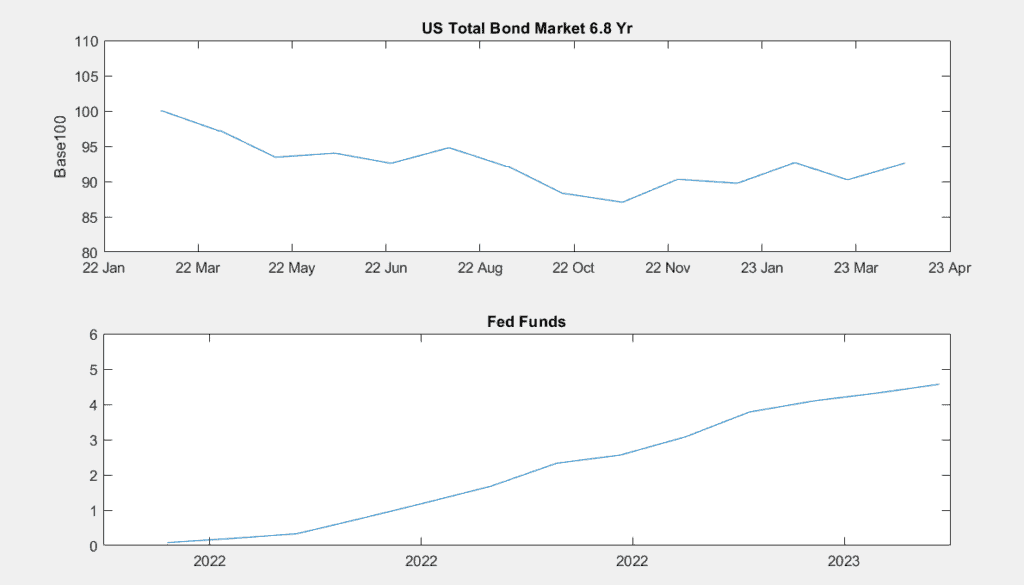

Bond Duration, Fed Rate, and Valuation Change

Update: April 3, 2023. Checking the Rule of Thumb that bond valuation will fall the duration times the rise in interest rates. If true, Total US bond market (VBTLX, the Vanguard bond fund) with duration of 6.8 years will have lost 32.3%. The actual decline was 7.4%.

The rule of thumb vastly overestimated the valuation decline.

Has the flight to quality been so massive as to overshadow the mathematics between rate and valuation? Looking at the plot below, we see holdings had dropped nearly 13% in Oct 2022, when the article below was written. Since then, despite continued Fed increases, the total US bond market has regained about 5% of valuation.

This is a good time to assess the value of bond holdings responding to rapid Fed Fund rate increase (up 3% this year). The rate increases are responses to inflation heating up in 2022.

This was obvious early this year; however, my estimate was only half the actual Fed Funds rise. In 2021 the TIPS fund Defined up 5%, while US Total Bond dropped 1½%. Using my rate forecast, I adjusted my bond internal allocations. I transferred the lion’s share of bond allocation to TIPS, from 21% to 59%.

| Bond Fund Type | Start of Year Proportion | Adjusted by Feb 1, 2022 |

| US Total Bond Market. 6.8 yr | 59% | 21% |

| US TIPS Short-Term. 2.8 yr | 21% | 59% |

| Int’l Govt Bond Fund. 8.5 yr | 20% | 20% |

The months since Feb 2022 have been very difficult months for bonds. How did my separate bond allocations perform?

| Bond Fund Type | Value on Feb 1, 2022 | Value on Sep 30, 2022 | Change |

| US Total Bond Market. 6.8 yr | 100 | 87.3 | -12.7% |

| US TIPS Short-Term. 2.8 yr | 100 | 96.5 | -3.5% |

| Int’l Govt Bond Fund. 8.5 yr | 100 | 88.3 | -11.7% |

They all lost principal value, but TIPS dropped only 3.5% while the US Total Bond Market lost 12.7% of principal value. That makes me happy that I transferred money to TIPS in Feb. 2022.

Two questions with brief answers.

- If I knew I was going to lose principal, why didn’t I move all funds to cash? Because I am not certain in my understanding of the market and I’m adjusting allocation rather than timing the market.

- Why didn’t I move all my bond funds to TIPS? I am learning and documented experience. In retrospect, to move all to TIPS would have been better.

Two unresolved questions for future consideration.

- The TIPS fund has the shortest duration, but also TIPS have their own behavioral characteristics. What role did the TIPS feature contribute to the funds relatively strong retention of principal value?

- I have Int’l Gov’t bond fund because it is recommended in the asset allocation. I really don’t understand the conditions that favor it or are headwinds for it. Perhaps the dollar going from weak to strong is bad, but the Int’l Gov’t fund indicates that currency hedging tries to remove that. I’ll continue to monitor.

In summary, the data shows that the longer duration 6.8 years resulted in a 12.7% loss of principal, significantly greater than the incremental gain due to interest earned (2%). A bad trade-off. Short-term TIPS fund was a good choice for holding value.

Good information on bonds.