Bitcoin, should it be in your portfolio?

Dec 19, 2022. Bitcoin trades at $16,700.

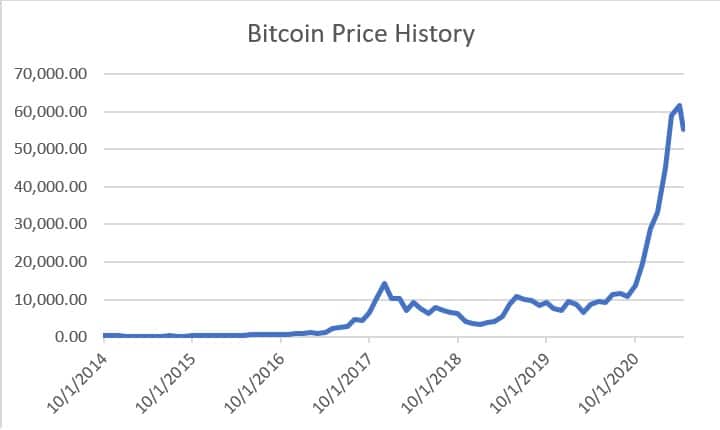

Bitcoin topped $60,000 in early 2021. That’s up from $3,000 in late 2018. A jump like that is enough to quicken any investor’s heart. So much so, that last week over lunch a friend asked me, should he invest in Bitcoin?

As soon as I realized he didn’t know what Bitcoin was, it was easy to say no, he shouldn’t. For that’s a prime theorem of investing—know what you are investing in. I also believe in Jim Cramer’s Rule. You should plan on one hour per week on every investment you hold (following the market, reading news stories, looking at charts, and noting analysts’ opinions).

For the record, Bitcoin is a currency, a very new currency, unveiled in 2008. It also has the unusual and exciting property of being independent of governments and federal banks. That means that inflation can’t be caused by flooding the economy with Bitcoins. There is a fixed supply. Also, independence of governments means that taxes on person-to-person payments can be avoided. There’s more, but that suffices for now.

Maybe you’re willing to put in the effort to learn and follow Bitcoin. What considerations should guide your investment decision? There are three fundamental questions you must answer.

- What role does your portfolio have in paying your living expenses?

- What determines Bitcoin’s value?

- What’s your personal appetite for risk?

Portfolio and Retirement Living Expenses

How important is your portfolio relative to your living standard?

If you are already retired, you know to what extent you rely on money from your portfolio to pay for your living expenses. If retirement is in the distant future, you must make your best guess by comparing expected income and expected living expenses. There are two basic possibilities as relates to the Bitcoin investment decision.

First, you need 0% (none, nada, nothing) from your portfolio to fund your living expenses in retirement. Perhaps you expect to have a pension, social security, and perhaps an annuity to pay your bills. Investments are pure gravy. The other option is you expect to use a portion of your portfolio every year in retirement to ensure you keep current on cars, houses, food, healthcare, and vacations.

Only in the first case should you even consider investing in Bitcoin? Why? Because the risk of losing the bulk of your money on a Bitcoin investment is very significant. You don’t want to risk your daily activities in retirement because you were wrong about Bitcoin.

Bitcoin Valuation

Bitcoin’s fundamental value arises from facilitating transactions in its sphere of economic activity. It’s a currency like the dollar, euro, yen, renminbi, or pound rather than a product like a car or iPhone. This distinction highlights that the performance of Bitcoin rests on its use growing faster than the dollar or other currencies.

It’s hard to assess Bitcoin’s value based on usage as a currency. Such data is scarce. In June 2018, Bitcoin was used to purchase goods worth merely $69 million, while Bitcoin transactions on exchanges amounted to billions of dollars. Currency trading is where tremendous growth in Bitcoin valuation occurred, not from an explosion of purchases, the baseline use of currency.

This year, we have followed news stories of major financial institutions including Bitcoin in their operations. They see that a market exists for it, but they are only dipping their toes in, as its valuation is extremely uncertain.

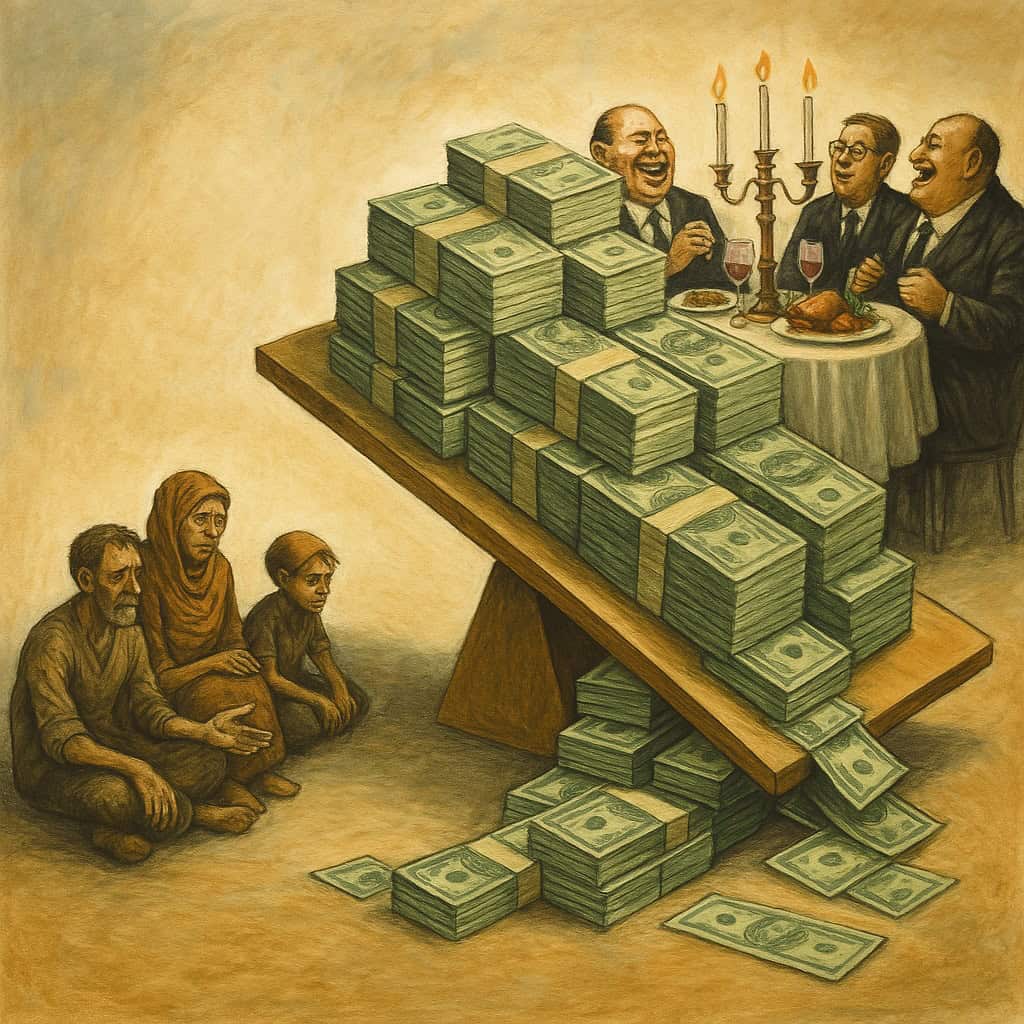

Bitcoin’s valuation will ultimately be based on the relative economic size and growth prospects of the purchasing market it serves. That market is the shadow economy as in under-the-table employment (avoiding taxes) and illegal goods (avoiding criminal laws).

Both aspects of the shadow economy may grow, both organically and because cryptocurrencies allow it. However, it’s an open question, what that growth may be. Will fifty-five thousand dollars seem wildly overdone in five years or merely a small price to pay for a rapidly growing, trillion dollar economic sphere avoiding governmental oversight?

The answer cannot be determined yet. It also depends heavily on potential government restrictions. Will governments forbid Bitcoin’s use? Will other cryptocurrencies, of which there are a multitude, knock Bitcoin off the top of the heap?

These are imponderables that make the investment such an awesome risk-reward play.

Personal Appetite for Risk

For this point, let’s assume you don’t need your portfolio for living expenses in retirement and that you understand the uncertainty of Bitcoin’s valuation. Now you must consider your appetite for and stomaching of risk.

How did you feel when the stock market dropped 30% in early 2020? Keep that feeling in mind. How would you have felt if you had purchased Bitcoin in Dec. 2017 for $20,000 and you needed to sell five months later? You would have received slightly less than $10,000. Would that 50% loss have upset you?

Just to be clear, there are reasons besides living expenses that might trigger your need to sell. For instance, you may want to take the family on a cruise for your fiftieth anniversary or two grandchildren need reliable cars right away or your landscaping needs a major redo so that you and your spouse can hold your heads up at barbeques that this summer post-vaccines portend.

If you’re rich enough and decide that the risk doesn’t daunt you, you still need to consider what portion of your portfolio you will risk.

The Bitcoin Price History (above) is incredibly alluring. It looks to be a rocket to riches, but what if you buy now? Your Bitcoin will cost about $55,000. If the sentiment propelling its rise fell back to last April’s level, your investment would then be worth $9,500. That’s a loss of over 80%. It happened in the up direction. It can happen in the down direction, too.

Bitcoin’s for You, If …

Bitcoin rises to a suitable investment if you can face losing 80% of the investment calmly.

Only you can judge how large or small a portfolio portion makes up an acceptable risk.

Good luck on your investment with the fancy child of the internet age.

Based on Bitcoin price history data available at finance.yahoo.com

Thanks for the updated BitCoin value.

You’re welcome.

BTW that’s a loss of over 70% if a person bought in early 2021