Asset Allocation Books

The Intelligent Asset Allocator by William Bernstein. This book provides a good grounding to the logic of diversification, but the 2001 edition doesn’t have the dreadful equity returns of the last 10 years, nor the surprising bond returns.

- How much would more recent returns affect the book’s forecasts and recommendations?

- I must get the newer returns with standard deviations (measure of risk) including the 1st decade of the 21st century, to feel comfortable with current prospects.

- Bernstein gives a good analysis of the shaky underpinnings of DOW 36000 (p. 127-132)

Lifecycle Investing by Ayres and Nalebuff, published 2010. I expected a great deal, but the book’s main emphasis was for younger investors using leverage to time-shift for diversification.

- I almost read the rest of the book out of contrariness, but it offered nothing further for me so I didn’t waste more than another hour hopscotching through it.

The Informed Investor by Frank Armstrong III, published in 2002. This covers much of the same territory as Bernstein’s Intelligent Asset Allocator. It was easy to skim and focuses on the action points that apply to my situation.

- Armstrong has a nice, methodical style.

- He gives useful factoids on what reward-risk combinations to expect (real GDP growth = 2%/yr; inflation 3.1%).

- He explains the various ways different people experience risk. Unfortunately he uses a 10% return as his baseline for examples (too optimistic by a yard).

Retirement Planning

The Informed Investor mentions Monte Carlo simulations which give you a chance to observe the significance of order of growth and loss in a portfolio’s size. I need to update the various outcomes in the Monte Carlo simulation that I based on historical returns and Burton G. Malkiel’s Random Walk Down Wall Street.

Armstrong makes economic observations which in the light of subsequent events give the opportunity to assess the worth of his economic maxims.Â

Here is a sample of his extravagant prose (p 262-263), “… not exactly an Oliver Stone-type thing, there is a loose conspiracy to keep investors in the dark … but the cost is small.”

Armstrong has a chapter specifically on investing during retirement—Yea!

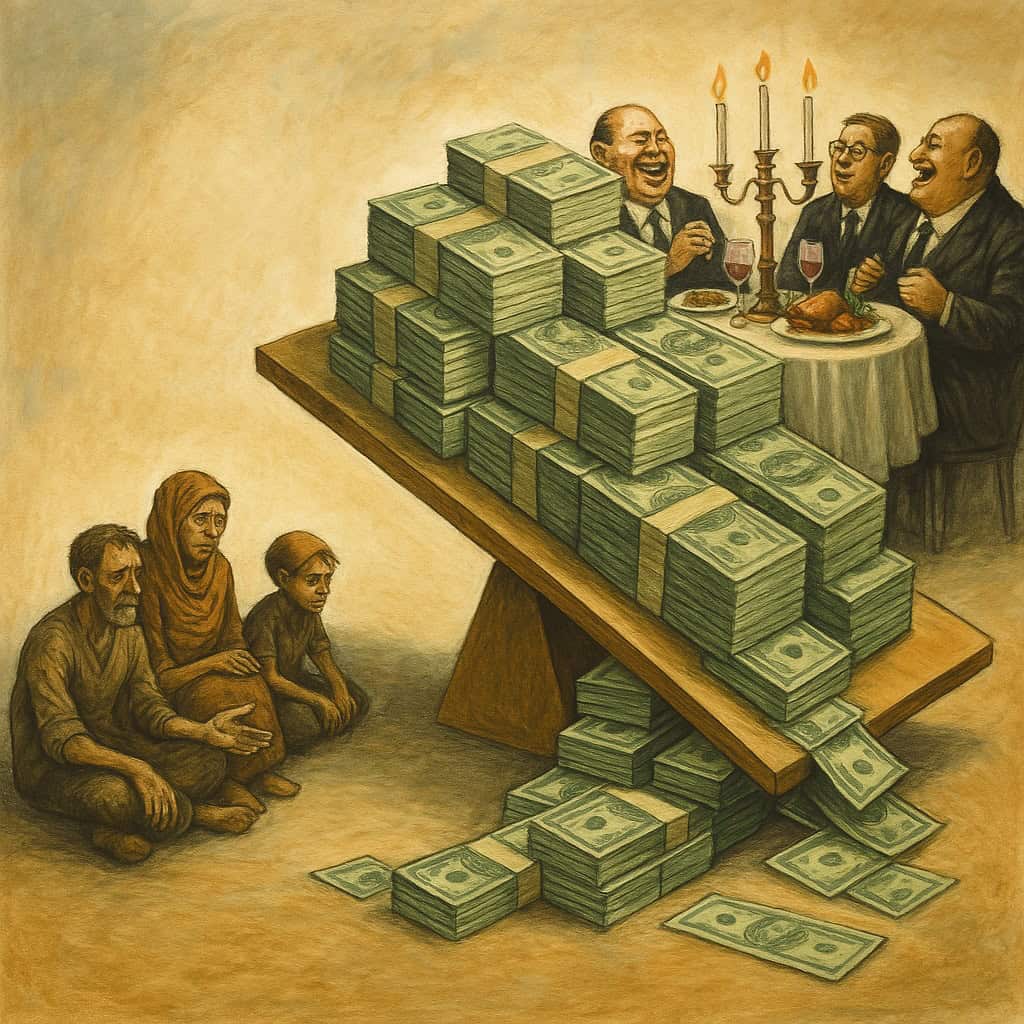

From page 146, “Capitalism is the greatest wealth-creating mechanism ever devised. As we serve our own interests, the value of the world’s economy increases.”Â

- The first sentence is surely right, but the second has constraints that are ignored. E.g. we have the housing crisis, the liquidity squeeze, subsequent market drop, and bailouts and economic stimuli.

- The net result was a subtraction from the world’s economy. Unfettered capitalism allows abuse which undercuts its virtues.

It is also worth remembering that the value of competition is to the aggregate market, not to the individual company. The benefit of an individual company is maximized when they subvert competition.

Portfolio Building

- General allocation. 55-60% stocks. 40-45% bonds. For simplicity, I don’t consider cash in savings.

- Passive funds. I don’t know enough, nor want to spend the time to actively monitor individual stocks or bonds. Funds tracking market-wide indexes have low turnover and low expenses.

- I want to diversify beyond the US dollar, but I don’t understand the relative magnitudes of their pros and cons.