Rate Cut. Bad Solution for Trade War Slump

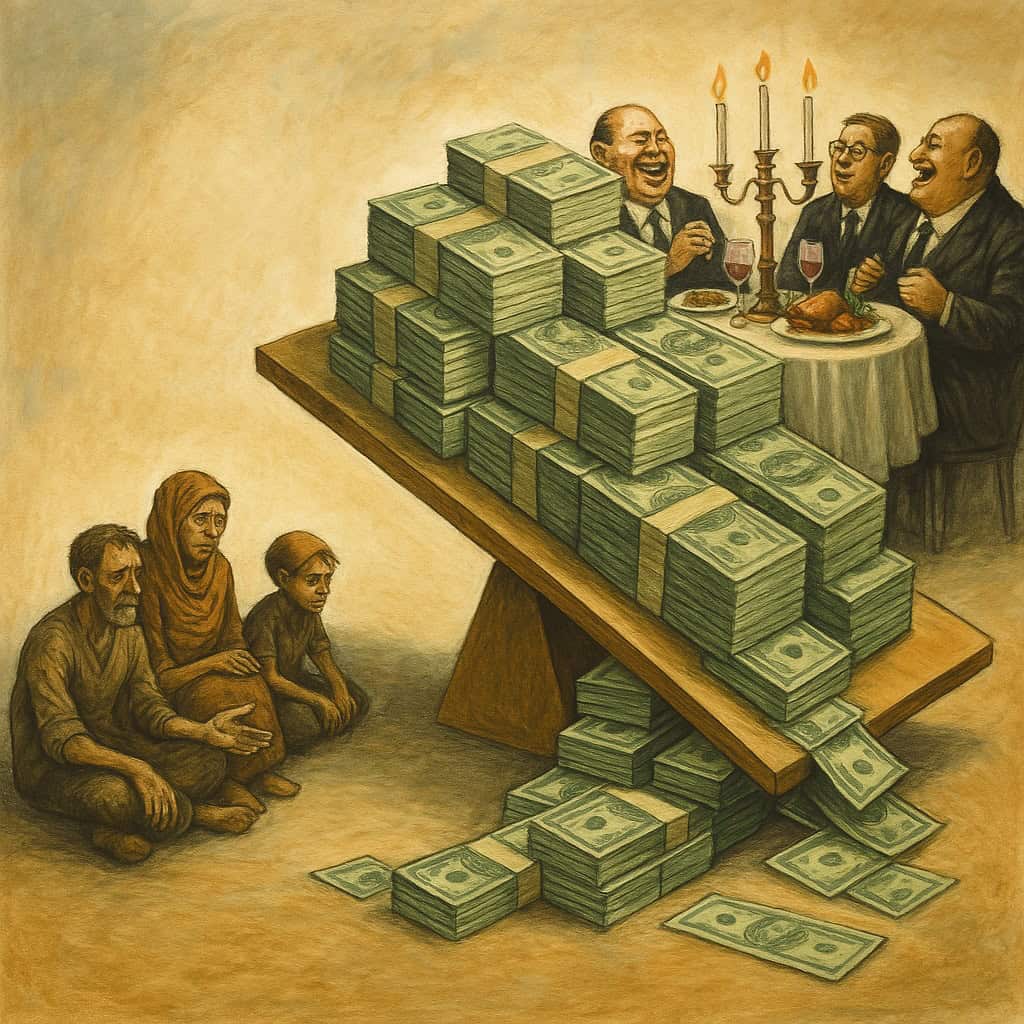

Fed rate cuts shouldn’t be the tool to offset the chaos caused by Trump’s trade war.

- When one policy mistake is made (Trump’s trade war) it is unwise to force a tool designed for a different economic purpose to correct the primary mistake. Why? Because the inherent purposes of the tool (Fed rate cuts) will affect its intended purposes in ways unexpected.

- Fed rate cuts are tools to boost economic activity and keep prices stable. Economic performance, since the Fed, Bush, and Obama avoided the Great Recession turning into another Great Depression, has been slow but steadily improving.

- Cutting rates now, increases risks of creating supply with no new markets, which could lead to a future economic recession due to over-supply pushing down GDP and economic activity.

- A review of Trump’s pre-presidential business activities shows his propensity for incurring debt to make good times look better, then having no room to maneuver when bad times arrive. He does not understand the relationship between debt and capacity.

- He understands debt, but only from a sole entrepreneur perspective. He tried to game the system. As a private citizen he could borrow and later repudiate it; however, that does not work when the country is the system.

The past shows that Trump mania is always been followed by ruin for his associates.

Are we, the nation, to be the next associates?