Deflation and Falling Energy Prices

There is debate going on now about deflation. Deflation, the general lowering of the price level, is worrisome because it’s argued that the expectation of lower prices in the future will result in a decrease in aggregate demand. That depresses economic activity (measured by GDP). I agree that would be bad, but the argument hinges on a debatable point:

People will put off future purchases because of CPI-measured deflation.

Consider the recent oil price plunge—from $100 down to $60 per barrel. That gets translated into falling energy prices, which through the energy component of the CPI market basket becomes a strong downward force on inflation. A disinflation or a deflation.

Yet as most of us know, energy’s falling price frees up more money for all the rest of our non-energy needs. Declining gasoline, diesel, and petrochemical prices help the non-energy economy grow, boosting activity of the 90% of the GDP that is not in the energy sector.

Alternative Spending rather than Elimination of Spending

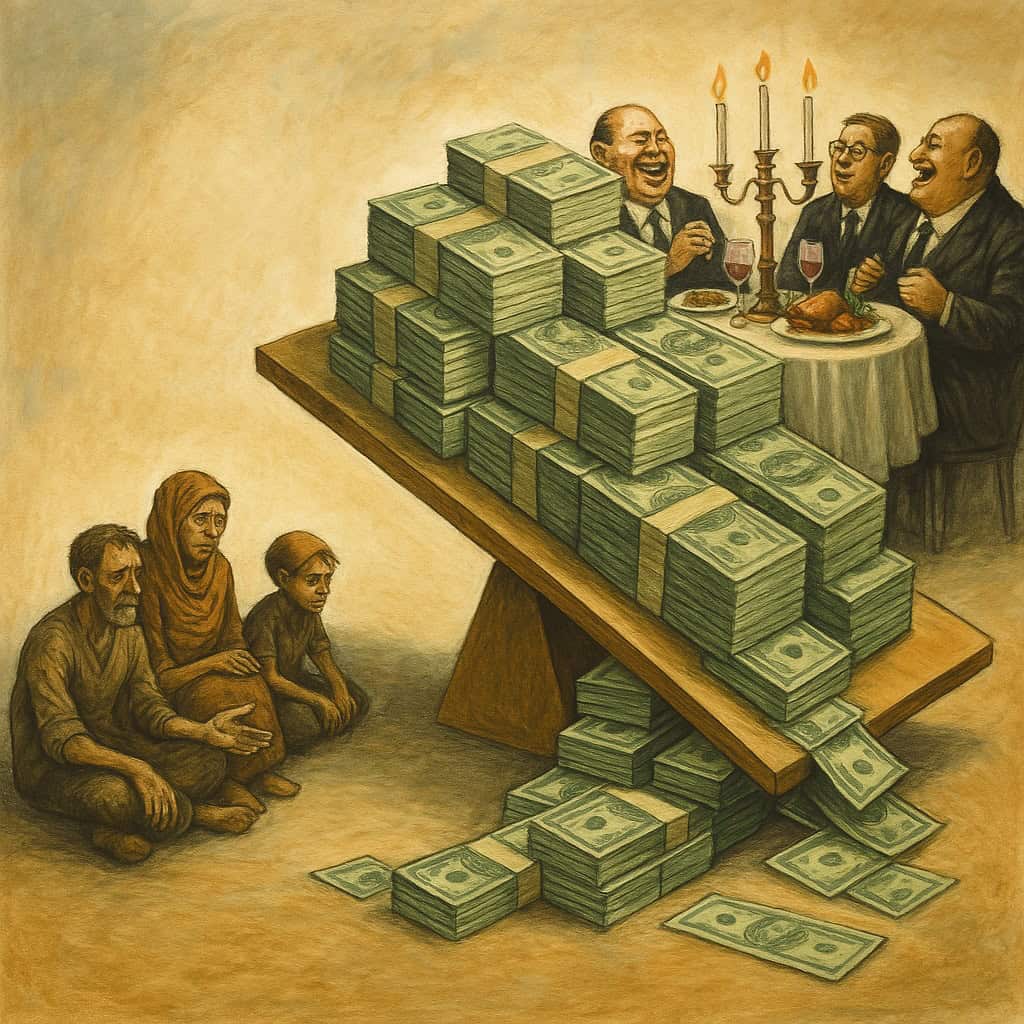

The logic of disinflation lowering aggregate demand is untrue, even more so for those people who spend 100% of their income. The decrease in energy costs shifts expenditures rather than depresses overall demand.

The economic decision-makers—the Fed, the legislative members, and professional media—make the mistake of basing policy choices on the energy-focused decline. They advocate fighting it by maintaining low interest rates and increasing money supply. However that action increases the danger of price bubbles across the spectrum of market sectors.