Treasury Interest Rates

Have you noticed the headlines and blurbs about the inversion occurring in Treasury rates? The information usually has a warning that rate inversion could signal a potential recession.

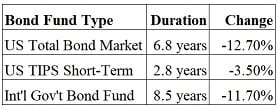

That’s wisdom worth heeding, but for anyone who has bond funds what is the impact of these falling rates? One rule of thumb is that a medium-term bond fund gains in value about 7 times the decline in the 10-year Treasury rate.

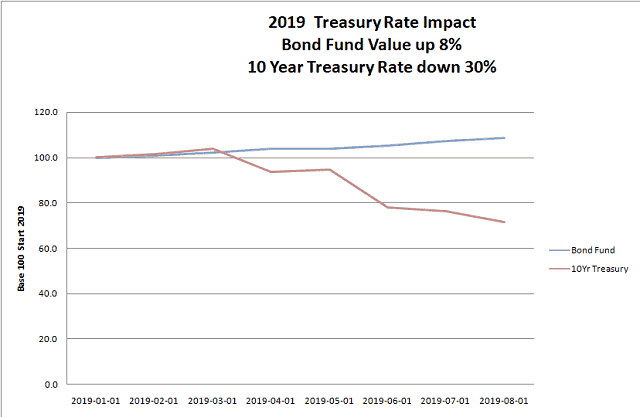

I wanted to see if this rule is holding now. To simplify comparison, I adjusted the value of the bond fund to 100 at the beginning of 2019.

The bond fund (blue) had a real return of 8% in 8 months. That’s awesome, not often achieved or expected. The 10-year Treasury rate declined 30% in that 8 months, from 2.66% to 1.90%.

The increase in bond value is a good bit above the rule of thumb, which pointed to 5% rise (7*3/4). Why might it be so far off? Perhaps because rates are so low already, the effect is magnified.

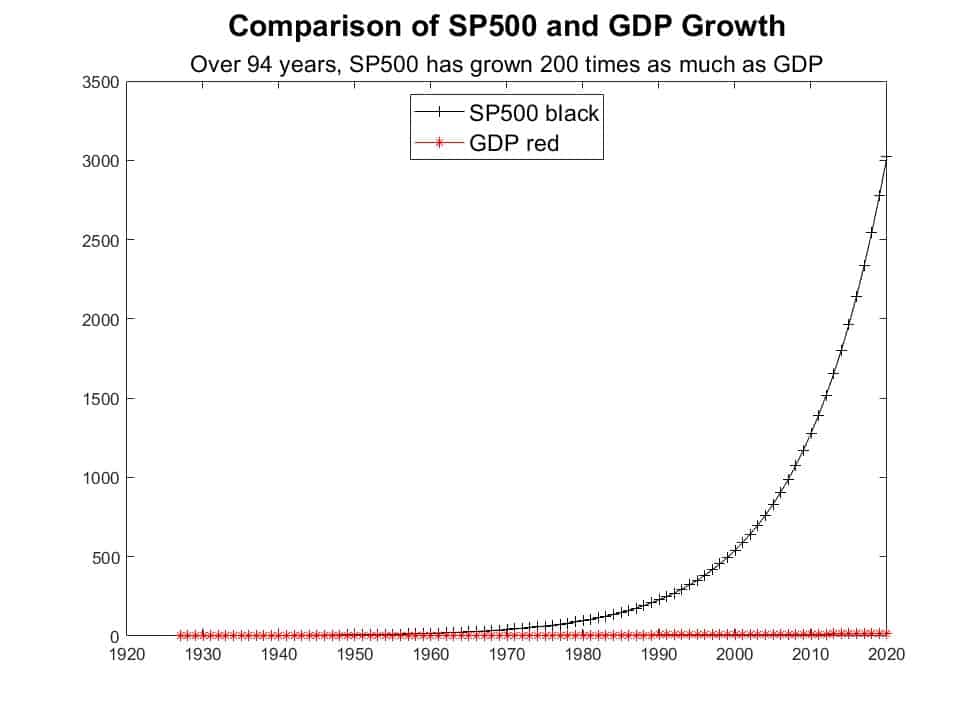

Passive Investing

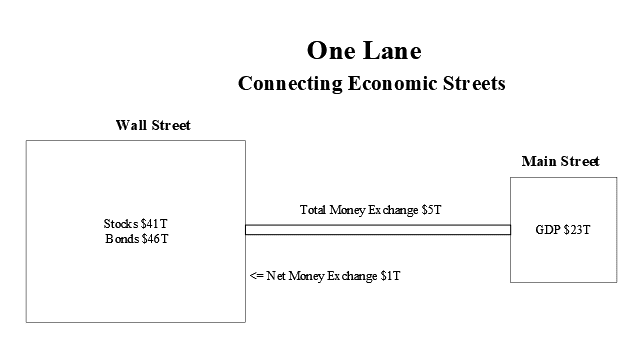

I’m a passive investor, meaning that I don’t adjust my portfolio due to routine occurs of the economic cycle. If secular changes occur, I will adjust. Changes to productivity and to consumption-investment ratio are two examples.

Another bit of financial news is that outside of the US, there are many trillions invested in bonds yielding less than 0%. Rules of thumb don’t allow for that. Neither does economic theory incorporate negative rates.

If a new economic theory explains those negative rates, that would likely occasion a secular change—in how government and corporate policies are enacted.

Modern Monetary Theory

Modern Monetary Theory (MMT) is being embraced by the progressive wing of the Democratic Party. MMT developed because of the failure of classical economics to successfully deal with the Great Recession.

If MMT prevails in government economic policy circles, that would be a secular change. A couple of its points are:

- Deficits don’t matter to nations which can print their own currency.

- The need for balanced budgets are a mirage

- The Fed and Treasury should be directed together by the government.

- Economies should be guided by taxation and government spending.

- The government would control the levers that adjust the economy.

- The government will always hire any willing working who can’t find employment elsewhere.

Although there needs to be an improvement in the understanding of budget deficits, it should not be by ignoring them, but by considering them relative to growth of the country’s net worth.

Modern Monetary Theory may be the left’s version of trickle-down economics, both wrong-headed. However, the target of a yearly balanced budget is a false target, as it neglects the growth in net worth that can more than offset a current year balance.

If a plank of the Democratic platform incorporates, say guaranteed employment, and the Democrat wins the White House, that would be a secular change requiring reconsideration of asset allocation.

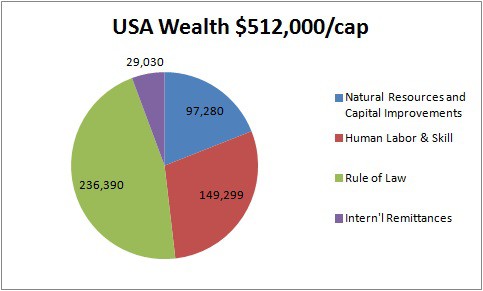

Net worth, a missing perspective in budget debates.